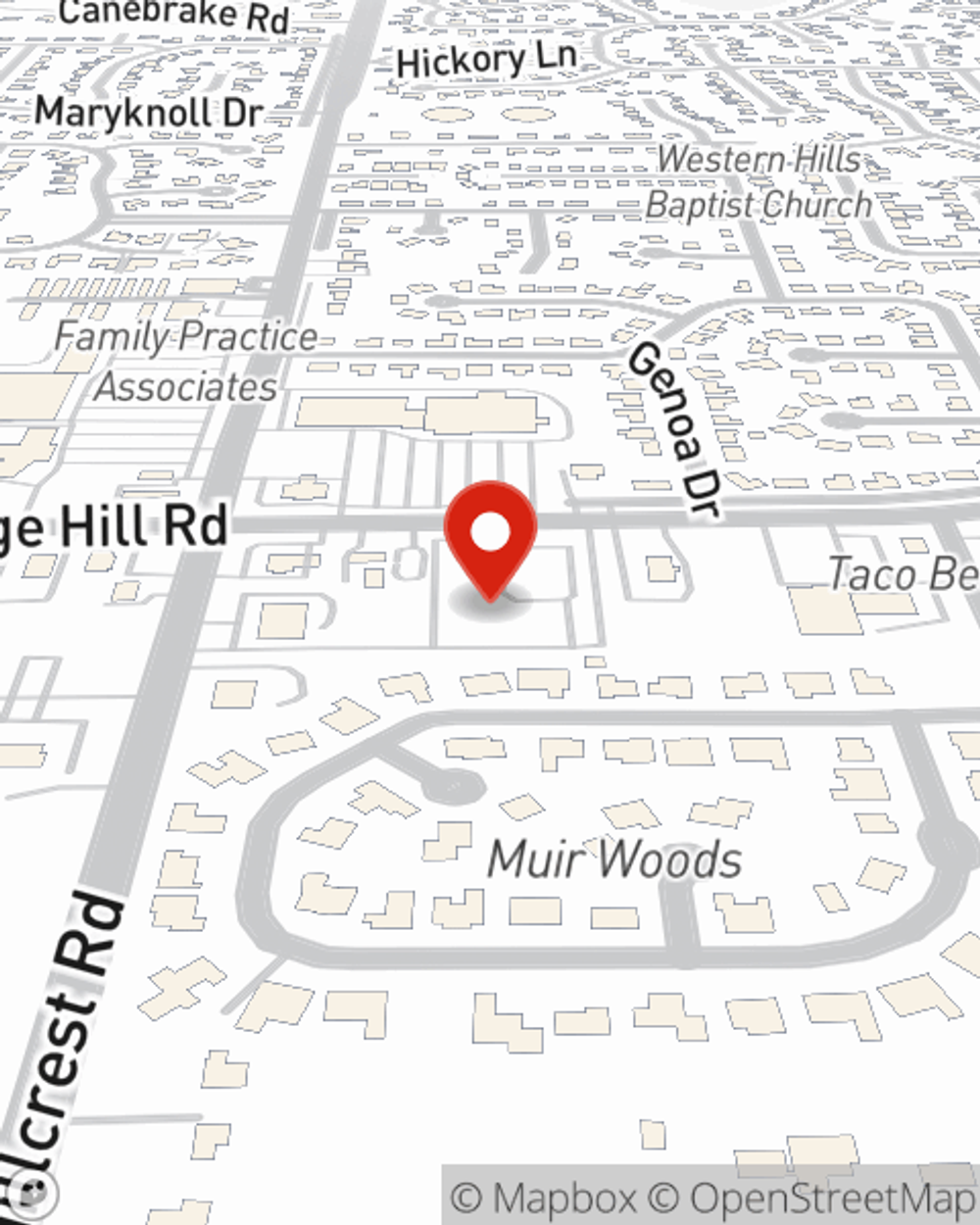

Business Insurance in and around Mobile

One of Mobile’s top choices for small business insurance.

Helping insure small businesses since 1935

- Theodore

- Saraland

- Semmes

- Grand Bay

- Pascagoula

- Spanish Fort

- Daphne

- West Mobile

- Spring Hill

- Midtown

- Chickasaw

- Bayou La Batre

- Brookley Field

- Fairhope

- Bay Minette

- Alabama

- Mississippi

- Gulf Coast, MS

- Mobile

- Moss Point

- Lucedale

- Gautier

State Farm Understands Small Businesses.

Operating your small business takes creativity, time, and quality insurance. That's why State Farm offers coverage options like errors and omissions liability, extra liability coverage, a surety or fidelity bond, and more!

One of Mobile’s top choices for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Allison Horner for a policy that safeguards your business. Your coverage can include everything from business continuity plans or extra liability coverage to employment practices liability insurance or commercial auto insurance.

Call Allison Horner today, and let's get down to business.

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Allison Horner

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.